This section provides an overview of Novozymes' principal accounting policies, the critical accounting estimates and judgments applied, a definition of materialityThe materiality assessment process identifies topics that pose either risks or opportunities for Novozymes’ business strategy. Relevant topics are those that may be considered important for reflecting the organization’s economic, environmental and social impacts, or for influencing the decisions of stakeholders. as well as the impact of new or amended IFRS standards and interpretations.

The symbols I/S, B/S and ESG show which amounts in the notes can be found in the income statement, balance sheet, and environmental data and social and governance data respectively.

The accounting policies described below apply to the consolidated financial statements as a whole. Accounting policies and critical accounting estimates and judgments are described in the notes to which they relate to enhance understanding. The descriptions of accounting policies in the notes form part of the overall description of accounting policies.

ACCOUNTING POLICIES

Consolidation

The consolidated financial statements comprise the financial statements of Novozymes A/S (the parent company) and subsidiaries controlled by Novozymes A/S, prepared in accordance with Group accounting policies. The consolidated financial statements are prepared by combining items of a uniform nature and subsequently eliminating intercompany transactions, internal stockholdings and balances, and unrealized intercompany profits and losses.

Consolidation of the environmental data and social and governance data follows the same principles as for the financial reporting.

Translation of foreign currencies

The consolidated financial statements are presented in Danish kroner (DKK).

Exchange rate differences arising between the exchange rate at the transaction date and the reporting date are recognized as Financial income or Financial costs.

Foreign currency transactions are translated into the functional currency defined for each company using the exchange rates prevailing at the transaction date. Monetary items denominated in foreign currencies are translated into the functional currency at the exchange rates prevailing at the reporting date.

Financial statements of foreign subsidiaries are translated into Danish kroner at the exchange rates prevailing at the reporting date for assets and liabilities, and at average exchange rates for income statement items.

The following exchange rate differences, arising from translation using the exchange rate prevailing at the reporting date, are recognized in Other comprehensive income:

- Translation of foreign subsidiaries’ net assets at the beginning of the year

- Translation of foreign subsidiaries’ income statements from average exchange rates

Non-IFRS financial measures

Novozymes uses certain financial measures that are not defined in IFRS to describe the Group’s financial performance, financial position and cash flows. These financial measures may therefore be defined and calculated differently from similar measures in other companies, and thus not be comparable.

The non-IFRS financial measures presented in the Annual Report are:

- Organic sales growthSales growth from existing business, excluding sales from business acquisitions and divestments, measured in local currency.

- Economic profitEconomic profit is defined as adjusted operating profit (NOPAT) less (average invested capital * WACC).

- ROICAdjusted operating profit (NOPAT) after tax as a percentage of average invested capital. EBIT is adjusted for net foreign exchange gains/losses and share of result in associates

- Free cash flow before acquisitionsCash flow from operating activities minus cash flow from investing activities and changes in net working capital, business acquisitions, divestments and purchase of financial assets.

The definitions of non-IFRS financial measures are included in the Glossary.

CRITICAL ACCOUNTING ESTIMATES AND JUDGMENTS

The preparation of the consolidated financial statements and the environmental data and social and governance data requires Management to make estimates and assumptions that can have a significant effect on the application of policies and reported amounts of assets, liabilities, income, expenses and related disclosures. The estimates and underlying assumptions are based on historical experience and various other factors. Actual results may differ from these estimates.

The estimates and underlying assumptions are reviewed on an ongoing basis. Changes in estimates may be necessary if there are changes in the circumstances on which the estimate was based, or more detailed information becomes available. Such changes are recognized in the period in which the estimate is revised.

The application of the Group’s accounting policies may require Management to make judgments that can have a significant effect on the amounts recognized in the consolidated financial statements. Management judgment is required in particular when assessing the substance of transactions that have a complicated structure or legal form.

The critical accounting estimates and judgments can potentially significantly impact the consolidated financial statements.

Basis of reporting

The consolidated financial statements of the Novozymes Group have been prepared in accordance with IFRS as adopted by the EU and further requirements in the Danish Financial Statements Act. Novozymes has prepared the consolidated financial statements in accordance with all the IFRS standards effective at December 31, 2018. The fiscal year for the Group is January 1 – December 31. The consolidated financial statements have been prepared on a going concern basis and under the historical cost convention, with the exception of derivatives and securities, which are measured at fair value. The accounting policies are unchanged from last year except for the implementation of IFRS 9 Financial Instruments and IFRS 15 Revenue from Contracts with Customers.

The consolidated environmental data and social and governance data have been prepared in accordance with principles that adhere to the following internationally recognized voluntary reporting standards and principles:

- AA1000 framework for accountability. The framework states that reporting must provide a complete, accurate, relevant and balanced picture of the organization’s approach to and impact on society

- UN Global CompactAn international UN initiative working to bring businesses together with UN agencies, labor and civil society to support 10 principles in the areas of human rights, labor standards, the environment and anti-corruption.. Novozymes is a signatory to the UN Global Compact, a voluntary policy initiative for businesses that are committed to aligning their operations and strategies with ten universally accepted principles in the areas of human rights, labor, environment and anti-corruption. Read Novozymes’ UNGC Communication on progress in the Sustainability section

- GRI Sustainability Reporting Standards 2016 (GRI Standards). Novozymes refers to GRI 101: Foundation 2016 to inspire its materialityThe materiality assessment process identifies topics that pose either risks or opportunities for Novozymes’ business strategy. Relevant topics are those that may be considered important for reflecting the organization’s economic, environmental and social impacts, or for influencing the decisions of stakeholders. assessment process and to GRI 102: General Disclosures 2016 to report contextual information about itself. Information is presented on Novozymes’ management approach to material issues, taking inspiration from GRI 103: Management Approach 2016. Topic-Specific Information is provided by referencing GRI Standards 200, 300 and 400 on Economic, Environmental and Social disclosures. Specific content for which information is reported is outlined in Novozymes’ GRI Content Index

The principles are unchanged from last year.

Defining materiality

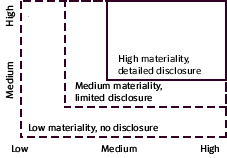

Novozymes’ Annual Report is based on the concept of materiality, to ensure that the content is material and relevant.

If items are individually immaterial, they are aggregated with other items of a similar nature in the statements or in the notes. Novozymes provides the specific disclosures required by IFRS unless the information is considered immaterial to the economic decision-making of the readers of these financial statements. The disclosures on environmental, social and governance (ESG) data include information on our management approach, targets, initiatives and related progress on the issues.

Novozymes’ materiality assessment is a systematic and rigorous process that integrates inputs from external stakeholders, trend analyses and internal engagement with relevant departments, for example senior leadership from Novozymes’ business divisions, Investor Relations, Risk Management & Controls, Public Affairs and Corporate Sustainability. This process results in identification of the ESG issues that are most material to Novozymes.

The illustration is a snapshot of the upper-right quadrant of Novozymes’ materiality matrix and depicts the 16 issues from the economic, environmental, social and governance areas that are most material to Novozymes’ business.

In 2018, we studied relevant macrotrends and changes in the internal and external environment to understand the impact they have on our current materiality matrix. As a result of this process, we identified one new issue in the economic category: Trade policies.

Changing global trade policies are impacting businesses all over the world. Therefore, it is important that we manage this issue to minimize the impact it may have on Novozymes’ business. All other issues remain unchanged.

For further details on the materiality assessment process, including a full list of all material issues and an explanation of how the issues are linked to the

Sustainable Development Goals (SDG)The UN Sustainable Development Goals (SDGs) are an intergovernmental set of 17 aspirational goals with 169 targets. The goals were officially implemented on September 25, 2015. targets, see

Materiality in the Sustainability section.

Impact of new accounting standards

Novozymes has adopted the following new or amended standards and interpretations from January 1, 2018:

- IFRS 9 – Financial Instruments: Classification and Measurement of Financial Assets and Financial Liabilities contains requirements for the classification and measurement of financial assets and liabilities, impairment methodology and general hedge accounting.

The implementation of IFRS 9 has had an insignificant impact on the consolidated financial statements. The implementation has resulted in additional disclosures; see Notes 4.2 and 5.1. The basis for calculating the allowance for doubtful receivables has been changed from incurred losses to expected losses. However, this has had only an insignificant impact on the allowances and thereby the consolidated financial statements.

The standard has been implemented prospectively using January 1, 2018 as the date of initial application. Novozymes has made use of the relief from restating comparative figures.

- IFRS 15 – Revenue from Contracts with Customers establishes a single comprehensive framework for revenue recognition.

The implementation of IFRS 15 has had an insignificant impact on the income statement and the related key ratios in the consolidated financial statements. Contract assets and Contract liabilities are now presented separately in the balance sheet.

The standard was implemented using the modified retrospective method. Novozymes made use of the relief from restating comparative figures and applied IFRS 15 only to contracts that were not completed as of January 1, 2018.

The following table shows the amounts by which the affected line items are impacted by the implementation of IFRS 15. Line items that are not affected are not included in the table, and consequently subtotals disclosed cannot be derived from the numbers provided.

The first column shows amounts prepared under IFRS 15, while the second column shows the amounts had IFRS 15 not been implemented.

The implementation has resulted in additional disclosures; see Notes 2.2 and 4.2.

- Amendment to IFRS 2 – Classification and Measurement of Share-based Payment Transactions clarifies the accounting for certain types of share-based payment transactions

- Annual Improvements to IFRSs (2014-2016) contains minor changes to three standards

- IFRIC 22 – Foreign Currency Transactions and Advance Consideration clarifies the accounting for transactions that include the receipt or payment of advance consideration in a foreign currency

The adoption of the amended standards and interpretations has not had a significant impact on recognition or measurement in the consolidated financial statements for 2018 and is not anticipated to have an impact on future periods.

New standards and interpretations not yet adopted

IASB has issued new or amended accounting standards and interpretations that have not yet become effective and have consequently not been implemented in the consolidated financial statements for 2018. Novozymes expects to adopt the accounting standards and interpretations when they become mandatory. The following accounting standard is considered the most relevant for Novozymes:

- IFRS 16 – Leases introduces a single lessee accounting model, requiring lessees to recognize leases in the balance sheet as a right-of-use asset and a lease liability, unless the lease term is 12 months or less or the underlying asset has a low value. In the income statement, the lease cost is replaced by depreciation of the leased asset and an interest expense for the financial liability.

The standard will be implemented on January 1, 2019 using the modified retrospective approach, where the right-of-use assets on transition are measured at an amount equal to the lease liability. Novozymes will make use of the relief from restating comparative figures and will not apply IFRS 16 to short-term leases and low-value leases.

The impact assessment analysis concluded that the implementation of IFRS 16 will have an insignificant impact on profit and loss, but will result in an expected increase in total assets and liabilities of DKK 615 million. Consequently, ROIC is expected to be impacted negatively by approximately 0.8 percentage point, and free cash flow in the Consolidated statement of cash flows will improve by approximately DKK 125 million. The right-of-use asset and lease liability are to be presented separately in the balance sheet or disclosed in the notes. Furthermore, the implementation of IFRS 16 will require additional disclosures.

Target/flagship initiatives

Target/flagship initiatives

Contributes to SDG target(s)

Contributes to SDG target(s)