Our risk management process reduces uncertainty and keeps us on track to achieve our ambitions and deliver value to our stakeholders. Our aim is to identify and mitigate all risks as early as possible in order to reduce their likelihood and impact.

The Board of Directors has overall responsibility for overseeing risks and for maintaining a robust risk management and internal control system. The Board recognizes the importance of identifying and actively monitoring all of the most pressing risks as well as the longer-term threats, trends and challenges facing our business.

Risk management framework

Novozymes operates an Enterprise Risk Management (ERM) process whereby the key risks facing the company are identified, assessed and mitigated at different levels of the organization. We monitor most risks by means of half-yearly reviews. However, at times, some risks require more frequent updates.

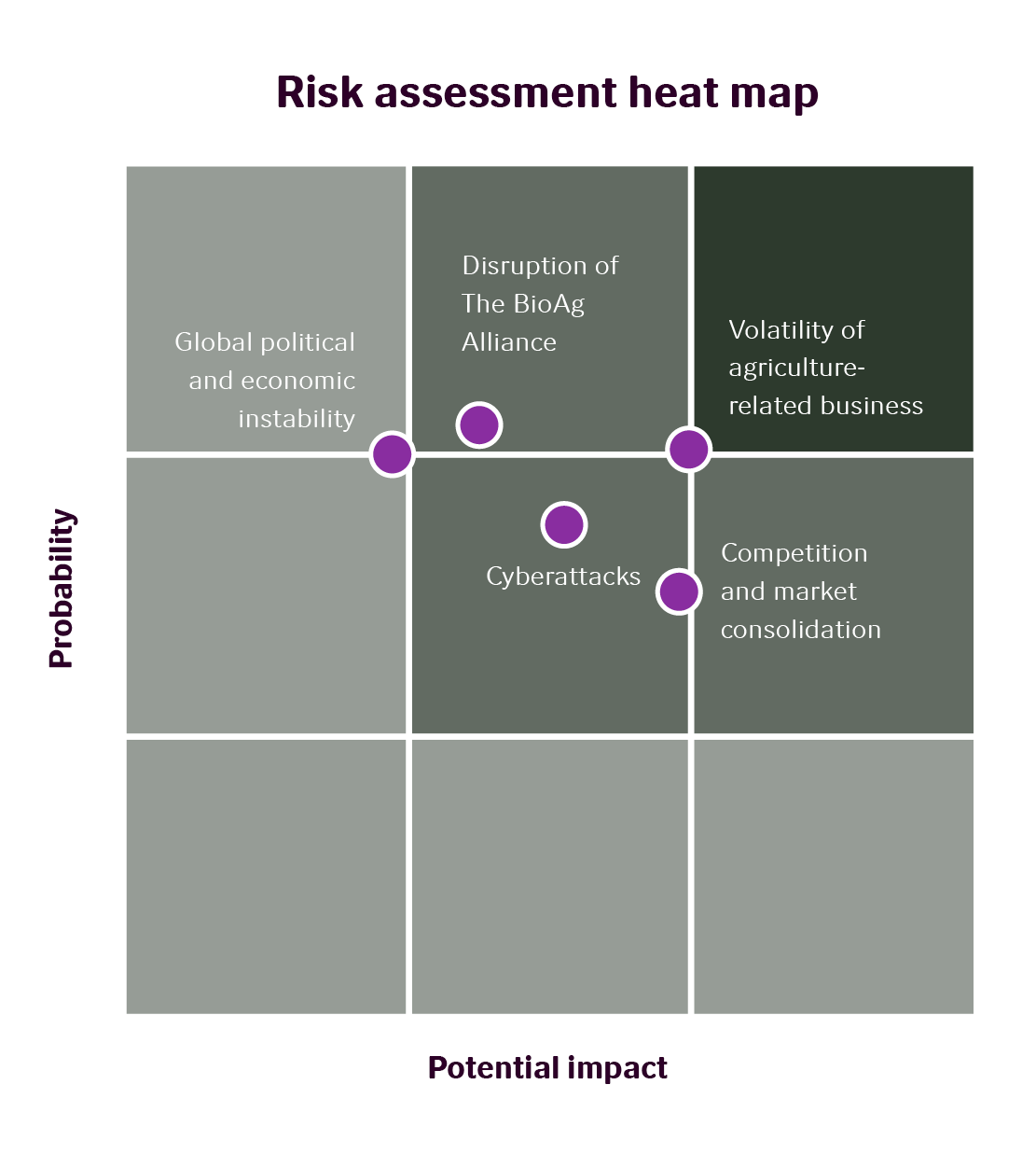

Risks are assessed based on a two-dimensional heat map rating system that estimates the impact of a risk on financials and reputation, and the likelihood of that risk materializing.

The most significant risks are reviewed and assessed by the Executive Leadership Team and the Board of Directors, who are also responsible for reviewing the effectiveness of the risk management and internal control processes throughout the year. Novozymes’ Risk Management & Controls department is responsible for identifying risks. The department also ensures that the senior management promotes risk awareness, engagement and ownership across the organization. Our vice presidents are responsible for mitigating all risks relevant to their respective areas of responsibility.

Risk assessment

Four of the key enterprise risks for 2019 are identical to those identified for 2018. The risk regarding Loss of knowledge has been changed to Cyberattacks to reflect the importance of the latter. In addition, “Global political and economic instability” has been added as a risk for 2019. This was previously identified as an emerging risk.

Competition and market consolidation

Novozymes’ market-leading position could be challenged by competition from existing and potential new competitors. Consolidation among competitors creates larger-scale players.

Potential impact

Increased competition could come from enzyme manufacturers offering new solutions or from new players with broader technology platforms. With increased digitalization, competition could also relate to how solutions are implemented in customer production. Although consolidation can make the market more stable, it could also increase competitors’ financial strength and bargaining power.

Mitigation

We continuously compete with other enzyme manufacturers through enhanced go-to-market strategies and tactics. We are accelerating regional innovation and establishing stronger local commercial teams. Introducing transformative innovations ensures that our product portfolio stands out.

We are also increasing investments in digitalization projects linking areas such as R&D, production, sales and finance, with the aim of further strengthening our competitive profile and profitability.

Volatility of agriculture-related business

Agriculture-related markets are inherently volatile on account of weather conditions, harvest quality, commodity prices, political mandates for ethanol blends and so on. In addition, the ongoing geopolitical uncertainty could add to the volatility of the industry.

Potential impact

Agricultural markets remained somewhat uncertain in 2018. If the volatility of the agricultural markets and poor global farm economics persist, this could challenge our value proposition and profitability in the industry. Without political support, the ethanol industry could be further challenged, putting pressure on Novozymes’ profitability. In terms of geopolitical uncertainty, higher import tariffs on agricultural crops, for example, could lead to acreage being further reduced, particularly in North America, where there is relatively high dependency on exports.

Mitigation

We are mindful of the ongoing geopolitical uncertainty and, as we move through 2019, we will keep a close watch on US ethanol inventories and prices as well as on certain crop prices. Substantial R&D investments enable us to develop even better solutions for improving yield and profitability. Our animal health portfolio is continuing to grow, and we now have two yeastSingle-celled microorganism, part of the fungus kingdom. products that will cement our position as a technology leader in biofuelsLiquid fuels produced from primary crops or biomass such as sugarcane, grains, agricultural residues, algae and household waste. They are typically used to replace gasoline and diesel in transportation..

Cyberattacks

It is extremely important to Novozymes to safeguard sensitive business information and critical assets against the global threat of theft. The risk of collateral damage from cyberwarfare or targeted attacks from cybercriminals is on the rise, due to rapid digital advancements, the geopolitical situation and a lack of regulations and laws.

Potential impact

Business opportunities with new or existing customers could suffer greatly if information about Novozymes' unique technologies or production strains is stolen. Cybercrime and hacker attacks could also negatively impact Novozymes if systems or privileged accounts are inaccessible for a long period.

Mitigation

Our more than 6,500 granted or pending patents act as our defense against infringement by competitors. In addition to the new security initiatives implemented in 2018, we will continue our efforts to mitigate cyberrisks through our updated security strategy, strengthened IT enterprise architecture and stronger focus on IT governance.

Disruption of The BioAg Alliance

Bayer’s acquisition of Monsanto continues to entail uncertainty for The BioAg Alliance, in which Novozymes and Monsanto are partners. The uncertainty relates to the future of the Alliance model.

Potential impact

A merged Bayer–Monsanto could expand the reach of The BioAg Alliance and the opportunities available to it. However, there is an element of uncertainty and risk if Bayer is not committed to, and successful in, driving and prioritizing this business area to reach its full potential. There could also be a risk if business is transitioned to a different collaboration model, although this would probably unlock other opportunities as well.

Mitigation

Novozymes’ shorter-term focus is to ensure successful launches of biological solutions on Bayer’s (Monsanto’s) corn seed, starting in 2019.

Novozymes is engaged in close dialogue with Bayer on exploring the best possible collaboration model for both companies for the future.

Global political and economic instability

The risk of political and economic instability was categorized as an emerging risk going into 2018. However, with developments during the year, we now see a high risk of continued and potentially greater instability in 2019. 2018 also saw rapidly changing trade conditions, for example the imposition of tariffs, making it difficult to mitigate risks.

Potential impact

Growing volatility in the global economy and political instability could impair business growth, not only for Novozymes but also in general.

Polarization and trade protectionism can make it more difficult for leaders to agree and work to strengthen global and regional institutions and networks. They also work against globalization generally and pose a risk to the global consensus on climate change and sustainable development.

Adverse economic conditions, such as those seen in the Middle East in 2018, may result in reduced consumer demand and increased price sensitivity among customers and consumers, while political changes may disrupt our operations and, ultimately, our sales. There is also a risk of exchange rate fluctuations and insolvency of customers, partners and suppliers.

Mitigation

Novozymes closely monitors political developments and macro- and microeconomic indications so as to be able to respond quickly to any adverse developments.

We actively engage in global forums on sustainability to maintain focus on the benefits of globalization and shared commitments, and we continuously remind the world of the importance of safeguarding a sustainable future.

Competition and market consolidation

In 2018, Novozymes defended our market-leading position by launching new innovations and optimizing go-to-market strategies for products that had already been launched, to ensure uptake by a wider group of customers. In addition, Novozymes further optimized our legal track for potential intellectual property rights infringement, particularly in emerging marketsMarkets that are becoming more advanced, usually by means of rapid growth and industrialization..

In 2018, Novozymes launched a new, transformative innovation, Balancius™. Transformative innovations set Novozymes apart from our competitors, as they have a profound impact on industries and, often, on people’s lives. As the first-ever enzyme for poultry gut health, Balancius™ pushes industry boundaries.

Throughout the year, advancements in our freshness platform also helped mitigate threats from competitors in Household Care. Our efforts to speed up our innovation pipeline and get closer to customers also paid off, with the launch of new, tailored solutions.

In 2018, we further prioritized and invested in digitalization. A Digital Transformations team was set up.

Volatility of agriculture-related business

In 2018, we continued our substantial R&D investments that enable us to develop new and even better solutions for improving yield and profitability, aimed at the agriculture-related businesses.

Through The BioAg Alliance, we launched Acceleron® B-360 ST, which promotes symbiosis between microbes Microscopic, living, single-celled organisms such as bacteria and fungi. and corn plants to strengthen root systems and increase plants' access to nutrients. Under the brand name BioRise 2, this technology will be used in combination with Acceleron® B-300 SAT.

In Bioenergy, we launched two products from our new yeast platform: Innova® Drive and Innova® Lift. For decades, the yeast strains used in the starch-based ethanolEthanol produced from starch, most often corn kernels. industry remained largely unchanged. The majority of all ethanol plants face operational problems related to yeast, which is impacted by high temperatures, infections and organic acids.

In animal health, we expanded our offerings within natural growth promotion, for example through our alliance with Boehringer Ingelheim. In addition to ensuring that our offerings were competitive, we also monitored competitor pricing in the industry to ensure that our products delivered an optimal price/performance ratio. We partnered with some of the key players in the agriculture-related markets, such as DSM in the feed alliance and Bayer (Monsanto) in The BioAg Alliance.

Loss of knowledge

In 2018, safeguarding knowledge and ability to operate, especially against cyberattacks, remained critical.

Novozymes continued our efforts to mitigate cyberrisks through our updated security strategy, a strengthened IT enterprise architecture, cyberthreat quick fixes and stronger IT governance.

We also continued our active patent strategy by protecting discoveries, production strains, formulations and relevant know-how. Actions continued to be taken to secure Novozymes’ assets through a global information security strategy, perimeter protection, access control and so on.

Disruption of The BioAg Alliance

The BioAg Alliance, Novozymes’ partnership with Bayer (Monsanto) continued to progress in 2018. The Alliance’s third codeveloped product, Acceleron® B-360 ST, was launched under the brand BioRise 2.

In 2018, Novozymes’ key priority was to ensure the continued success of The BioAg Alliance, especially in a period of uncertainty and change for our partner. Bayer’s acquisition of Monsanto closed in the summer of 2018, and we are in close dialogue with Bayer exploring how to best reap mutual benefits from continued collaboration within the BioAg area.

In addition to short-term risks, Novozymes identifies emerging risks capable of affecting our business in the longer term (three years and beyond). These risks are determined through our enterprise risk management process and integrated trendspotting exercise. We evaluate and monitor these long-term risks and assess their potential to impact our business and growth. To help us prepare for addressing these risks, we engage with relevant key stakeholders to develop long-term strategies.

In an evolving risk landscape, one of our emerging risks from 2018 – Global political and economic instability – has become even more pertinent in the short term, and this risk has therefore been moved to our list of key risks for 2019.

We are currently closely monitoring a number of emerging risks, among which the following two have been assessed to be of greatest relevance for Novozymes. Some emerging risks also pose opportunities for a business such as Novozymes, due to our strong focus on sustainability and innovative solutions, for example within the food & nutrition space and wastewater treatment.

Concerns about new technology

There is growing consumer demand for health, wellness and natural products and, conversely, tighter regulatory control on the biotechnology and chemical sectors. Over the coming years, we expect to see an acceleration in technology and further significant innovation in these areas.

Consumers are more health conscious and vocal in expressing growing concerns about the intended and unintended consequences of biotechnology and genetic engineering on society. Governments are increasingly scrutinizing issues related to environmental and human health risks, bioethics, gene technology and intellectual property rights.

Novozymes recognizes the need to improve the general level of knowledge about biotechnology and genetic engineering. We find safe and sustainable answers to some of the planet’s most pressing challenges – and as we explore the increased use of biotechnology, we will continue to engage in and push for open dialogue about the consequences of biotechnology with stakeholders.

Water-constrained future

Global demand for water is expected to outstrip supply by 2030. Rising demand, combined with the decline in the availability of clean water, is exacerbating the water situation. Many parts of the world are experiencing, or expecting, extreme water crises in the form of severe droughts, floods and declining water quality caused by pollution. Governments are responding with stricter regulation, and companies are driving action through various corporate-led initiatives (e.g. the CEO Water Mandate and AgWater Challenge).

Novozymes is committed to sustainable water management within our own operations and across the value chain. We invest in improving our water efficiency. Investments are being made to develop a more comprehensive overview of water consumption at all of our sites, and this will enable us to improve water efficiency. Besides the risk that this issue poses to our operations, increasing demand for clean water solutions also serves as an opportunity for our business. Clean Water & Sanitation is one of Novozymes’ core contributions to the SDGs.