Reading guide

The Accounts and performance section is presented in a manner that attempts to make the information provided understandable and relevant to readers. This includes providing relevant rather than generic information.

The notes have been divided into eight sections: Basis of reporting, Net operating profit after tax, Invested capital, Net working capital, Capital structure and financing, Other financial notes, Environmental data and Social and governance data. The purpose is to provide a clearer understanding of what drives performance.

The notes have been structured to provide an enhanced understanding of each accounting area, by describing relevant accounting policies and sources of estimation uncertainty in the notes to which they relate.

Novozymes explains the accounting choices that have been made within the framework of the prevailing International Financial Reporting Standards (IFRS) and has elected not to repeat the actual text of the standard, unless this is considered particularly important for an understanding of the note content. The descriptions of accounting policies in the notes form part of the overall description of accounting policies.

The notes for environmental and social and governance data also disclose Novozymes' management approach to the reported issue.

The symbols I/S, B/S and ESG show which amounts in the notes can be found in the income statement, balance sheet, and environmental data and social and governance data respectively.

Basis of reporting

The consolidated financial statements of the Novozymes Group have been prepared in accordance with IFRS as adopted by the EU and further requirements in the Danish Financial Statements Act. Novozymes has prepared the consolidated financial statements in accordance with all the IFRS standards effective at December 31, 2017. The fiscal year for the Group is January 1 – December 31. The consolidated financial statements have been prepared on a going concern basis and under the historical cost convention, with the exception of derivatives and securities, which are measured at fair value. The accounting policies are unchanged from last year.

The consolidated environmental and social and governance data have been prepared in accordance with principles that adhere to the following internationally recognized voluntary reporting standards and principles:

- AA1000 framework for accountability. The framework states that reporting must provide a complete, accurate, relevant and balanced picture of the organization’s approach to and impact on society

- UN Global Compact An international UN initiative with the intention of bringing companies together with UN agencies, labor and civil society to support ten principles in the areas of human rights, labor standards, the environment and anticorruption. See www.unglobalcompact.org.. Novozymes is a signatory to the UN Global Compact, a voluntary policy initiative for businesses that are committed to aligning their operations and strategies with ten universally accepted principles in the areas of human rights, labor, environment and anti-corruption. Read Novozymes' UNGC Communication on progress in the Sustainability section

- GRIAn international, multistakeholder body working on a standardized framework for reporting environmental, social and economic information. See www.globalreporting.org. Sustainability Reporting Standards 2016 (GRI Standards). Novozymes refers to GRI 101: Foundation 2016 to inspire its materialityThe materiality assessment process identifies key topics that pose both risks and opportunities for Novozymes’ business strategy. It is based on a systematic analysis of internal and external stakeholder perspectives. Material topics merit inclusion in our report, as they reflect our economic, environmental and social impacts or because they might influence stakeholder decisions. assessment process and to GRI 102: General Disclosures 2016 to report contextual information about itself. Information is presented on Novozymes' management approach to material issues, taking inspiration from GRI 103: Management Approach 2016. Topic-specific information is provided by referencing GRI Standards 200, 300 and 400 on Economic, Environmental and Social disclosures. Specific content for which information is reported is outlined in Novozymes' GRI content index

The principles are unchanged from last year.

Impact of new accounting standards

Novozymes has adopted the following new or amended standards and interpretations from January 1, 2017:

- Amendments to IAS 7 Disclosure Initiative was published in January 2016 and requires an entity to provide disclosures that enable users of financial statements to evaluate changes in liabilities arising from financing activities

- Amendments to IAS 12 Recognition of deferred tax assets for unrealised losses was published in January 2016 and clarifies the requirements on recognition of deferred tax assets for unrealized losses on debt instruments measured at fair value

- Annual Improvements to IFRSs (2014-2016) was published in December 2016 and contains minor changes to three standards

The adoption of the amended standards and interpretations has not had any impact on recognition or measurement in the consolidated financial statements for 2017 and is not anticipated to have an impact on future periods.

New standards and interpretations not yet adopted

IASB has issued a number of new or amended accounting standards and interpretations that have not yet become effective and have consequently not been implemented in the consolidated financial statements for 2017. Novozymes expects to adopt the accounting standards and interpretations when they become mandatory. The following accounting standards are considered the most relevant for Novozymes:

- IFRS 9 – Financial Instruments: Classification and Measurement of Financial Assets and Financial Liabilities was published in July 2014 and contains requirements for the classification and measurement of financial assets and financial liabilities, impairment methodology and general hedge accounting.

We have completed an analysis to assess the impact of implementing IFRS 9.

Based on the current treasury policy for hedging of risks, the implementation of IFRS 9 will not have an impact on the consolidated financial statements.

The simplified expected loss model will be applied to trade receivables, but will not significantly impact the allowance for doubtful trade receivables. However, the implementation of IFRS 9 will impact disclosures on the allowance for doubtful trade receivables.

The standard will be implemented using January, 2018 as the date of initial application. We will make use of the relief from restating comparative figures and will only apply IFRS 9 as of January, 2018.

- IFRS 15 – Revenue from Contracts with Customers was published in May 2014 and establishes a single comprehensive framework for revenue recognition. The standard is effective for annual periods beginning on or after January 1, 2018.

During 2017, an analysis has been made of the impact of implementing IFRS 15. The analysis covered the most significant contracts, standard contracts and contracts where the analysis indicated that the implementation of IFRS 15 may impact revenue recognition.

The analysis concludes that the implementation of IFRS 15 will not have a significant impact on the income statement or the related key ratios in the consolidated financial statements. However, items currently recognized in the balance sheet will be presented separately as contract assets and contract liabilities, and the disclosures on revenue will be impacted.

The standard will be implemented using the modified retrospective method. Novozymes will make use of the relief from restating comparative figures and will only apply IFRS 15 to contracts that are not completed as of January 1, 2018.

- IFRS 16 – Leases was published in January 2016 and introduces a single lessee accounting model, requiring lessees to recognize leases in the balance sheet as a right-of-use asset and a lease liability, unless the lease term is 12 months or less or the underlying asset has a low value. In the income statement, the lease cost is replaced by depreciation of the leased asset and an interest expense for the financial liability.

We have started analyzing the Group's current contracts containing a lease to assess the impact of implementing IFRS 16. However, the full impact is not yet known. Based on the ongoing analysis, the new standard is expected to result in an increase in total assets of approx. 3-5%. Consequently, the related key ratios in the consolidated financial statements, such as EBITDA Earnings before interest, tax, depreciation and amortization. and ROIC Adjusted operating profit (NOPAT) after tax as a percentage of average invested capital. EBIT is adjusted for net foreign exchange gains/ losses and share of result in associates., will be impacted. The right-of-use asset and lease liability are to be presented separately in the balance sheet or disclosed in the notes. Furthermore, the implementation of IFRS 16 will impact disclosures.

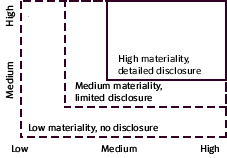

Defining materiality

Novozymes' annual report is based on the concept of materialityThe materiality assessment process identifies key topics that pose both risks and opportunities for Novozymes’ business strategy. It is based on a systematic analysis of internal and external stakeholder perspectives. Material topics merit inclusion in our report, as they reflect our economic, environmental and social impacts or because they might influence stakeholder decisions., to ensure that the content is material and relevant to the readers.

The consolidated financial statements consist of a large number of transactions. These transactions are aggregated into classes according to their nature or function, and presented in classes of similar items in the financial statements and in the notes as required by IFRS. If items are individually immaterial, they are aggregated with other items of a similar nature in the statements or in the notes. The disclosure requirements throughout IFRS are substantial, and Novozymes provides the specific disclosures required by IFRS unless the information is considered immaterial to the economic decision-making of the readers of these financial statements.

The consolidated environmental and social and governance (ESG) data include the parameters that, based on an assessment of materiality for Novozymes and its stakeholders, are deemed the most relevant.

Novozymes’ materiality assessment is a systematic and rigorous process that integrates inputs from external stakeholders, trend analyses and internal engagement with relevant departments, for example senior leadership from Novozymes' business divisions, Investor Relations, Risk Management & Controls, Public Affairs and Corporate Sustainability.

The process results in two outputs: 1) disclosures on key trends, which can be found in the section on Novozymes’ business model, and 2) disclosures on material ESG issues, which can be found in the Notes sections.

The illustration is a snapshot of the upper-right quadrant of Novozymes’ materiality matrix and depicts 15 ESG issues that are most material to Novozymes’ business. The materiality matrix includes some new issues and other changes compared with the previous year.

For further details on the materiality assessment process and an explanation of all the changes in the matrix compared with 2016, see Materiality in detail in the Sustainability section.

Limited reporting scope

The environmental data cover those activities that could have a significant impact on the environment. Sites with activities considered not to have a significant environmental impact are not included. Such sites comprise sales offices, R&D labs, and sites with limited blending and storage of products. However, measures are taken to ensure that at least 97% of the total Novozymes quantity of the measured environmental parameter is included in the reported numbers.

Target/flagship initiatives

Target/flagship initiatives